Think, decide, and executefrom a single AI interface

Built to make your team extraordinarily productive, Braind is the best way to run your company with AI.

From Wall Street trading floors to Silicon Valley labs - our team is trusted and supported by leading institutions

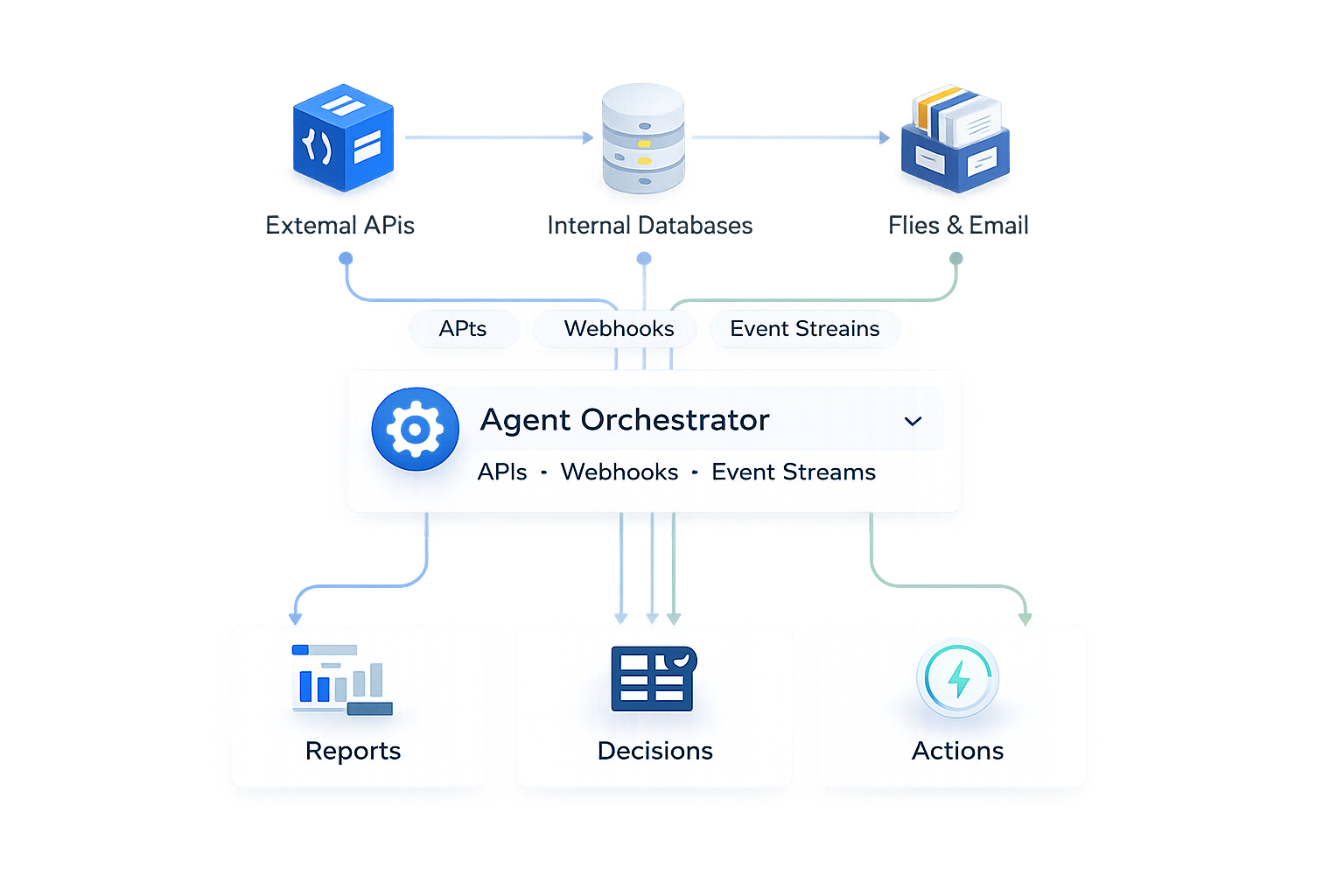

Agent

Delegate company work so you can focus on higher-level decisions.

See Braind in Action

Execute complex, multi-step workflows across enterprise applications.

Investment Portfolio Analysis

Analyze financial performance across our investment portfolio. What strategies are generating the highest returns?

#1

Investment

Growth Fund A

Strategy Type

Equity Growth

Annual Return

18.3% annual return

Risk Level

Medium risk

Performance Ratio

1.8 Sharpe ratio

#2

Investment

Income Fund B

Strategy Type

Fixed Income

Annual Return

8.5% annual return

Risk Level

Low risk

Performance Ratio

2.1 Sharpe ratio

#3

Investment

Alternative Fund C

Strategy Type

Private Equity

Annual Return

25.2% annual return

Risk Level

High risk

Performance Ratio

1.5 Sharpe ratio

| # | Investment | =Strategy Type | =Annual Return | =Risk Level | =Performance Ratio |

|---|---|---|---|---|---|

| 1 | Growth Fund A | Equity Growth | 18.3% annual return | Medium risk | 1.8 Sharpe ratio |

| 2 | Income Fund B | Fixed Income | 8.5% annual return | Low risk | 2.1 Sharpe ratio |

| 3 | Alternative Fund C | Private Equity | 25.2% annual return | High risk | 1.5 Sharpe ratio |

Trusted by professionals

Security

Enterprise-Grade Security,

Built In

Intelligence isolated per organization

Enterprise-grade security practices

End-to-end encryption

Hosted on infrastructure supporting ISO 27001 and SOC 2 standards.

Designed to support CCPA requirements.

GDPR

Designed to support GDPR requirements.